Introduction on TDS

The abbreviation for TDS is Tax Deducted at Source. The provisions related to TDS are governed by Income Tax Act, 1961.

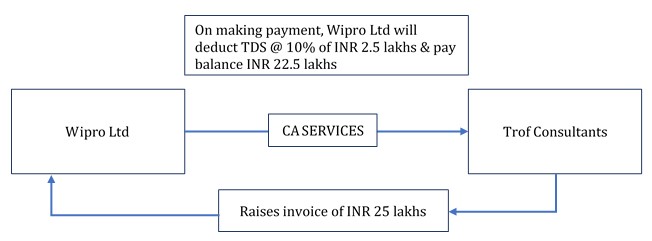

Typically, a person has to pay tax on income earned at the year end. By the mechanism of TDS and advance tax provisions (covered in a separate blog), government is able to collect tax in advance and in instalments across the year.

Any person or entity making specified payments such as rent, commission, professional fees, salary, interest etc. is liable to deduct TDS

Here, Trof Consultants received net amount from Wipro Ltd. Trof will show INR 25 lakhs as their income for calculating tax. The TDS amount deducted i.e. INR 2.5 lakhs will be adjusted against final tax liability at year end. Therefore, it means that recipient will take credit of amount already deducted & paid on his behalf.

| Particulars | Amount (INR) |

| Final tax liability of Trof Consultants | 8,75,200 |

| Less: Tax deducted by Wipro Ltd | 2,50,000 |

| Total tax payable in cash/bank | 6,25,200 |

Answers to Basic Questions on TDS

- When is TDS to be deducted?

Ans: Any person making specified payments mentioned under the Income Tax Act are required to deduct TDS

2. What is Specified Payments?

Ans: Specified payments are various sections provided for TDS deduction. There are more than 30 sections for TDS deduction, however, we have given the most important & routinely used sections.

| Section | Nature of Payment | Threshold (INR) | Individual / HUF | Others |

| 192 | Salaries | Slab basis | Slab basis | – |

| 194A | Interest (Others) | 5,000 | 10 | 10 |

| 194C | Contractor – Single Transaction | 30,000 | 1 | 2 |

| 194C | Contractor – During the F.Y. | 100,000 | 1 | 2 |

| 194H | Commission / Brokerage | 15,000 | 5 | 5 |

| 194I | Rent of Land and Building – F&F | 240,000 | 10 | 10 |

| 194J | Professional Fees / Technical Fees / etc. | 30,000 | 10 | 10 |

For full list of sections for TDS deduction is given in the below link: https://www.tdsman.com/downloads/TDS_and_TCS-rate-chart-2021.pdf

3. Is TDS to be deducted for all transactions?

Ans: No, TDS has to be deducted for only some specified transactions. Also, TDS is not to be deducted on sale of goods

4. Is TDS restricted to only India?

Ans: No, TDS is all over the world. However, in foreign countries, it is called as “Withholding of Tax” or “Pay as your earn tax” or “Pay as you go”

5. Is there any unique number for TDS deduction?

Ans: Yes, Tax account number (TAN) is to be obtained for TDS & TCS (refer our next article on TCS). It is also called as Tax Deduction Number or Tax Collection Number

6. TAN has to be mentioned for all TDS payments?

Ans: Yes, except for deducting tax under section 194-IA (i.e. from sale consideration of land/building)

7. Since TDS is tax paid in advance, what happens when my tax is nil or negligible

Ans:

a) If tax is Nil: TDS need not be deducted on your income (Form 15G & 15H to be submitted to banks for not deducting TDS or no deduction certificate in other cases)

b) If tax is Negligible: Obtain Lower deduction rate certificate from tax authorities

8. Should TDS to be deducted for all persons?

Ans: No, TDS need not be deducted if the payment is to individual or HUF whose books are not required to be audited under Income Tax Act (Section 44AB provisions)

9. What should be done in case TDS deducted & not utilised

Ans: File income tax return & claim refund of unutilised TDS

10. Should TDS to be deducted on GST portion

Ans: As per circular 1/2014, TDS not to be deducted on GST portion provided such GST is separately indicated in invoice (Earlier this circular was used for not deducting TDS on Service Tax)

11. When TDS is to be deducted

Ans: TDS has to be deducted at time of accounting expense entry or payment entry whichever is earlier

12. What is the entry of TDS deduction at the time of accounting expense?

Ans:

| Entry | Type of account | Interpretation |

| Expenses A/c Dr | Nominal Account | Debit all expenses & losses |

| To TDS payable A/c | Real Account | Credit what goes out |

| To Creditors A/c | Personal Account | Credit the giver |

13. What is the entry of TDS deduction at the time of payment?

Ans:

| Entry | Type of account | Interpretation |

| Creditors A/c Dr | Personal Account | Debit the receiver |

| To TDS payable A/c | Real Account | Credit what goes out |

| To Bank A/c | Real Account | Credit what goes out |

14. Why there is concept of TDS?

Ans: This concept was introduced by government for following reasons:

a) Government requires funds throughout the year. Hence, TDS helps government with funds to run the country

b) It helps government to recover funds in advance in order to avoid struggle for recovering tax at year end.

Ex: if an individual or entity becomes bankrupt, government would not be able to collect tax.

c) Avoid tax evasion as few of them do not offer all their income for tax purpose

d) Reduce tax burden by collecting tax in installments & not lump sum payment at the end

e) Prevention of defaulters of taxpayers

15. When TDS deducted has to be paid?

Ans: 7th of subsequent month except for March. For March month, the payment has to be made before 30th April

16. Which form should be used for paying TDS?

Ans: ITNS 281 for all payments except 194-IA. Form for TDS under section 194-IA is Challan No 26QB

17. Is it compulsory to pay TDS through e-payment?

Ans: No, e-payment is mandatory only for companies & those covered under tax audit (as per section 44AB)

18. What is TDS return?

Ans: TDS return is to be filed every quarter about details of TDS deducted, challan details, deductee details & deductor details.

19. Who is Deductor & Deductee?

Ans: Deductor is the one who deducts TDS. Deductee is one on whom TDS is deducted. In simple words and relating to our example, deductor is Wipro Limited and deductee is Trof Consultants.

20. What is the due date of returns, interest & penalty?

Ans: Below is the link where you can read about due date of TDS return, penalty for non-filing & delayed filing of TDS returns, interest provisions for non-deduction, delayed payment or non-payment of TDS:

Due Dates for E-Filing of TDS/TCS Return AY 2020-21 (FY 2019-20)

It is not necessary for mugging up provisions like due date, interest, tax rates, penalty or ceiling limit of any law. The key part of knowing any law is by understanding its “WHY”, “WHEN” and “HOW” it works.

Similarly, for TDS provisions, we aim at getting you comfortable with the fundamentals of how TDS works to help you stand out in the herd and make a mark at workplace.

Happy Learning!

#troftraining #learnwithtrof